Source: Securities Times

Section 1 important reminder

1 The summary of this annual report comes from the full text of the annual report. In order to fully understand the company’s business results, financial status and future development plans, investors should read the full text of the annual report carefully from www.sse.com.cn.cn website.

2. 1. The board of directors, supervisors and directors, supervisors, and senior managers of the company ensure the authenticity, accuracy, and integrity of the annual report content.Essence

3 2. All directors of the company attended the board meeting.

Four days of Heng Accounting Firm (special common partnership) issued audit reports with standards without reservations for the company.

5 The profit distribution plan or the provident fund transfers of this reporting period decided by the Board of Directors

Audit by Tiantianheng Accounting Firm (Special Ordinary Partnership), as of December 31, 2023, Jiahe Food Industry Co., Ltd. (hereinafter referred to as “Company”) at the end of the parent company available for allocating profits was RMB 770,673,379.73.After the decision of the board of directors, the company’s total share capital after the total share capital registered on the shareholding registration date of the equity of the equity of the equity division of equity was distributed in 2023.The profit distribution plan is as follows:

The company intends to deduct the total shares after the total share capital registered by the equity registration date of the shares of equity distribution shares.(Including tax).As of March 31, 2024, the company’s total share capital was 400,010,000 shares, and 1,264,001 shares were deducted from the company’s repurchase of special securities accounts. In this regard, the total cash bonus was set up 111,648,879.72 yuan (including tax).This year’s company’s cash dividend ratio was 43.32%.In 2023, the capital provident fund is not transferred to the share capital and the redemption of red shares.

The profit distribution plan still needs to be submitted to the company’s 2023 annual shareholders’ meeting for consideration.

Section 2 The basic situation of the company

1 Company profile

2 Reporting period The company’s main business profile

(1) The industry classification of the company is located

During the reporting period, the company mainly engaged in the research and development, production and sales of powder oil, coffee, plant base and other products.According to the “Classification Standards for the National Economic Industry” (GB/T4754-2017) issued by the National Bureau of Statistics, the industry classification of the company’s main products is as follows: powder oil products belong to the C14 food manufacturing industry, coffee, plant base and other products belong to the belongings to belong toC15 wine, beverages and refined tea manufacturing.

(2) The industry’s industry situation

1. Overview of the development of the powder oil industry

According to the “2024-2030 China Last Deep Research and Investment Strategic Planning Report” released by the Huajing Industrial Research Institute, in 2023, the end production of China’s fat planting was about 985,200 tons, an increase of 8.24%year-on-year.The volume was about 77,200 tons, an increase of 9.72%year -on -year.At present, the annual consumption of powder oil and fat in my country is nearly 800,000 tons, and the compound growth rate in the past three years is 11.4%, which still maintains a high -speed growth.The company’s oil powder market is mainly distributed in the field of tea, food industry, and foreign trade. The proportion of business share in various fields is relatively stable. In the business cycle, various fields have reached the expected growth goal.

According to the data of Ai Media Consultation, the size of the Chinese new tea market in 2023 will reach 333.38 billion yuan. With the more diversified consumption scenarios of new tea drinks, the categories will continue to innovate and broaden.The size of the Chinese new tea drink in the year reached 374.93 billion yuan.It can be seen that there is still a large market space and development potential in the Chinese new tea industry. The development of the new tea industry will also effectively drive the development of the upstream powder oil industry.

Overview of foreign trade: In recent years, the Chinese new tea brand with the strength of the sea has begun to expand to overseas markets.According to the “2022 Tea Drinking Development Report” released by Meituan Food and Food Union, it is expected that by 2025, the total scope of the global tea market will reach US $ 318.56 billion.The scale of tea drinking has grown steadily, the base of high consumer groups, consumer drinking age is younger, drinks become healthy, and new tea and powder oil market prospects are broad.

2. Overview of the development of the coffee industry

In the coffee business, in order to ensure the steady and healthy development of the coffee industry, in recent years, the state and local governments have successively introduced a series of related policies, including industrial development policies, raw materials import and export and trade policies, foreign investment policies, etc., and actively encouraged and promoted China.The coffee industry has developed steadily.

According to Ai Media Consultation data, the market size of the Chinese coffee industry reached 485.6 billion yuan in 2022.At the same time, the Chinese coffee market is expected to maintain a growth rate of 27.2%, which is much higher than the average growth rate of 2%in the world.The “Encouraging Foreign Investment Industry Catalogs (2022 Edition)”, which was implemented from January 1, 2023, includes two parts: the country encourages foreign investment industry catalogs and the overall industrial catalog of foreign investment in the central and western regions, all of which have proposed the development of the coffee industry.In 2023, the local government of Yunnan Province has continuously launched four policies related to coffee, encouraging localities to vigorously develop high value -added industries such as coffee, and set up a group of expert teams to overcome common technologies and core key technologies, and build a comprehensive modern agricultural system.The high -speed innovation of the Chinese coffee market, the emergence of Internet stimulation of diversified coffee brands, and promoting the new era of Chinese coffee entry and experiencing dual upgrades, the trend of diversification is obvious.

According to the “2023 China City Coffee Development Report”, the Chinese coffee market is still relatively early, with total consumption and per capita consumption than mature markets such as Europe, America, Japan and South Korea, and great growth potential.The depth layout of the entire industry chain has become the key to building the core competitiveness of the brand.The scale of coffee in the current coffee has a bright growth rate, its status has increased year by year, and the consumption scenarios are rich to meet the needs of various types of people.The cost -effective and quality of quality are giving up, the proportion of low -priced coffee increases, the coffee brands infiltrate the low -line cities, and the sinking market has developed significantly.Under the leadership of the new generation of consumers, the multi -level demand burst out, breaking the border of the original scene border to achieve breaking binding, and becoming a new wind -oriented new wind at the moment. Under the wave of consumption upgrades, content marketing gradually breaks the original border and realizes the field expansion.

3. Overview of the development of the plant -based industry

Globally, the plant -based market has gradually entered a rapidly developing promotion period from the initial market exploration period in recent years, and the market potential of the plant base industry, including oat milk, has greater market potential.With the blessing of the pursuit of a healthy diet, in recent years, European and American and Chinese consumers have accelerated the acceleration of plant milk. The penetration rate of plant milk in Europe and the United States and Chinese markets has also accelerated, and plant milk has gained broad market development space.With the improvement of people’s living standards and health awareness, more and more intake of high -quality protein will increase, consumers’ demand for oat milk will greatly increase, and oat milk has greater market potential in China.

my country’s plant -based beverage industry is in the important strategic opportunity period of “transformation of plant protein beverages to plant milk positioning”, and its development prospects are broad.In recent years, the plant -based milk market has risen rapidly. Botanical milk has been promoted to the market with the positioning of “milk substitutes”, which is more in line with the growing nutrition and health needs of consumers, and it is more in line with the current development trend of low -carbon environmental protection.Plant milk is more priced than traditional plant protein beverages. The consumption scenario is daily drinking and has the characteristics of higher consumption frequency.

In March 2022, the State Food and Material Reserve Bureau issued the “Fourteen Five -Year Plan” Food and Material Reserve Technology and Talent Development Plan “. The plan clearly states that” new technology demonstration of grain and oil nutrition “should be used as” key innovation in the field of grain and oil nutrition and health health.One of the tasks, “Promote the creation of innovative food and oil nutritional foods such as zero add oat milk.”According to the statistics of Ai Media Consultation, the size of the Chinese oat milk market in 2022 was 6 billion yuan, the growth rate exceeded 50%. In 2023, the scale of the Chinese plant protein beverage market was about 140 billion yuan, and the growth rate exceeded 10%.In summary, the development of plant base industries such as oats has a good policy background.It is expected that in the next two years, the market size of oat milk will remain rising year by year, and the year -on -year growth rate will remain at about 45%.

Since the listing, the company has re -adjusted the blueprint of the company’s development, and is based on the mission of “opening a new era of plant nutrition”, and is committed to the corporate vision of “Jiahe to make life more healthy and delicious”.According to the company’s development strategy, the company will continue to focus on the endogenous growth of the existing core business. In the future, the company will take the powder oil business, coffee business, plant base business, and innovative food business as the main development engine to promote the coordinated development strategy.Provide customers with safe, healthy, high -quality, delicious products, and provide customers with a full range of food and beverage solutions with excellent product quality and advanced R & D technology.

1. Main business and products

(1) Powder oil business

Powder oil is one of the company’s core products.The company’s powder oil products mainly include milk tea, powder oil for coffee, powder oil, and roasting powder oil.In recent years, the company has fully realized the 0 anti -non -hydrogenation, which meets the current consumer demand and future development trend of powder oil, which has driven the upgrade and healthy development of the tea industry products.

The company has participated in the drafting of many standards such as “Planting Fast”, “Powder Oil” and “Botanical Cream” to deeply cultivate the field of special oils.The company has a health powder oil (international) joint innovation center and Suzhou functional powder oil engineering technology research center.The company’s participation in the “Key Technology and Industrialization of Food Industry Special Oils and Development Manufacturing and Industrialization” project represented by powder oil products has won the “Second Prize of the National Science and Technology Progress Award of 2020”.The company’s lipid planting (powder oil) products are also “special new” products in Jiangsu Province.At the same time, the company has successively launched patented technology products such as cold -soluble lipids, acid resistance, and soot, which has independently developed foam powder oil products, which further enriches the company’s product structure and meets the needs of customer differentiation.

According to the statistics of the Huajing Industrial Research Institute, the end production of China’s fat planting in 2023 was about 985,200 tons, an increase of 8.24%year -on -year, and the demand for the last fat planting was about 77.12 million tons, an increase of 9.72%year -on -year.In the future, the company will continue to increase research and development investment and technology innovation, actively deploy downstream market and sales channels, expand high -quality customer groups at home and abroad, further enhance the company’s powder oil and fat business business scale and market share, consolidate the leading position in the powder oil industryEssenceAt the same time, make full use of the core technology and industry experience accumulated by the company in the powder oil industry, conform to the development trend of the healthy and functionalization of powder oil products, develop functional powder fat products that meet market demand, further optimize product structure, enrich product varieties,At the same time, the upgrade and healthy development of powder oil products are driven.

(2) Coffee business

”Coffee” is one of the three major drinks in the world. Because of its unique mellow flavor and refreshing effect, it has become a popular drink for modern people’s daily life.The company’s coffee products mainly include quick -soluble coffee, coffee solid beverages, cold coffee liquid, roasted coffee beans, grinding coffee powder, hot coffee liquid, frozen -dried coffee, etc., covering the full product chain of coffee.The company has independent -developed cold -extract coffee standardization lines. The factory has passed ISO9001, ISO14001, Halal certification, FSSC22000 certification, and Rain Forest Alliance (RA) certification.

With the rapid spread of domestic coffee consumption concepts and the gradual development of consumption habits, the Chinese coffee market has been in a high -speed growth stage in recent years.The Chinese coffee market is still relatively early, and the total consumption and per capita consumption are much lower than that of mature markets such as Europe, America, Japan and South Korea, and great growth potential.The Chinese coffee market is still relatively early, and the total consumption and per capita consumption are much lower than that of mature markets such as Europe, America, Japan and South Korea, and great growth potential.Although the per capita drinking cup for Chinese coffee is only 9 cups per year, coffee consumption in first- and second -tier cities is much higher than this.At the same time, driven by first- and second -tier cities, the wave of coffee consumption is gradually radiating to third- and fourth -tier cities.

In the future, the company will give full play to the synergistic effect of coffee business and powder oil business, increase the research and investment in the application of coffee in different scenarios, continue to launch high -quality coffee products for the market and customer groups, and implement coffee production and construction through the implementation of coffee production and constructionThe project enhances the grade and added value of the company’s coffee products, and enhances the competitiveness of the company’s coffee products.In addition, the company will grasp the rapid growth of the coffee market, increase market development and marketing, actively cooperate with downstream large food and beverage customers, enhance the company’s brand awareness, promote the continuous growth of coffee business, and further increase the company’s profitability.

(3) Botanical base business

With the enhancement of environmental protection and health awareness, the concept of plant -based botanical bases in the world in recent years has emerged. Botanical beverages cover all types of plant -based protein beverages, including soybeans, rice, nuts (such as peanuts, almonds), grains (such as oats, quinoa, quinoa, quinoa, quinoa, quinoa, Corn), seeds (such as linen seeds, Chia seeds) and coconut beverages.The company’s plant -based products mainly include organic oat milk, oatmeal, oatmeal, and thick coconut milk and coconut milk products.The company has in -depth joint development and industrialization of results in the National Academy of Grain Science and Technology in terms of oats and plant milk.

In 2023, the “very wheat” organic oats series was successfully launched. With its high -quality product characteristics and healthy brand image, it won market recognition.And successfully moved to overseas regions such as Singapore.In overseas markets, products are also favored by consumers, and sales have shown a positive growth trend.This achievement not only laid a solid foundation for the brand’s international strategy, but also injected new impetus into the company’s long -term development.

(4) Innovative food and other businesses

Innovative food is an important supplement to the diversification of the company to meet the needs of customers’ one -stop procurement.

Over the years, the company has been deeply cultivating in the food and ingredient industry, accurately locate market demand, actively digs out the needs of professional customers and has continuously reached industrialization through continuous innovation.Continue to develop accurate, adapted standardized products for tea, coffee, roasting, large catering and other channels.The company applies UHT sterile irrigation technology in jelly, pudding, prefabricated sterile beancurds, roasted fairy grass and other fields. It provides the majority of new tea and catering customers with an instant jelly, pudding, beanflower, and roasted grass products in standardized stores.While the menu, it saves time, and greatly reduces the cost of tea drinks and prefabricated dishes.The company has insight into the differentiated needs of customers, and develops a 4x concentrated “Kalima” thick cotton product and rich and smooth coffee drinks concentrated cream products with the needs of the tea drink market.”, Provide more solutions to the market in a timely manner to help industry innovation.

2. The company’s business model and operation strategy

(1) Procurement mode

The company adopts a “order -oriented order” procurement model. The company has a complete ERP system. All sales orders regularly summarize through the material management system and the production system for forming various raw materials demand forms and production plans.Finally, a specific procurement list is formed by the production plan and raw material requirements form.Based on the judgment of the macroeconomic, industry economy and market conditions, the procurement department, and then comprehensively comprehensively qualified suppliers’ quotation, settlement models and other factors, with the company’s scale advantage, sign a long -term framework agreement with suppliers, and based on market conditions and sales ordersLock the price of raw materials in a timely manner, thereby reducing the price fluctuation risk of raw materials to a certain extent.At the same time, the company conducts some strategic procurement for the prediction of the general raw materials of the community based on the product characteristics and the annual operating budget.The company strictly controls the inventory during the operation, and the company compiles the raw material inventory table daily; on the premise of ensuring security inventory, according to the fluctuations in market materials, the inventory is reasonably optimized to reduce the cost of holding raw materials.

The company has formulated and improved documents and systems such as “Administrative Measures for Procurement of raw materials”, “Procurement Control Procedures”, “Review and Management Measures for the Primary Material Supplier”, established a comprehensive procurement process, and introduced the SRM system of the procurement management system, and strictly strictly strictly.Purchase according to the process.The company’s raw material procurement is coordinated by the procurement department. The procurement department has formed a qualified supplier list by comprehensive inspection of the supplier’s production capacity, product quality, and delivery period.Stable and reliable.

(2) Production mode

Based on market demand, industry development status, its own operations and sales, the company formulates production plans after combining its own production capacity to reasonably allocate resources and organizes manufacturing.Specifically, the company’s comprehensive annual sales plan, product renewal and iteration progress, previous year sales data, combined with inventory conditions, arranged production in time according to market forecasts in order to complete production and delivery in time when customer orders are issued.Reasonably allocate production capacity, shorten the supply time, and quickly respond to the market’s order demand.

The company’s production and operation work is generally coordinated by the production planning department. The production planning department is responsible for coordinated contacts from various departments such as production, warehousing, logistics, and procurement, and issued production instructions through the ERP system.According to the annual/monthly production plan, the production planning department conducts production efficiency analysis and optimization in accordance with the customer’s rolling order requirements and product inventory, and formulates the weekly production plan and issue production orders.Based on the production orders, the production departments are arranged for production personnel to arrange work, implement production and manufacturing, and complete product production work according to the production orders. At the same time, strict product quality monitoring at various production stages ensures stable and reliable product quality.

(3) Sales mode

Based on the market experience in the fields of powder oil, coffee, plant base and other products for many years, the company has adopted a direct sales model, which can strengthen the development of direct customers and the grasp of the end market.

In order to meet the changes in the internal and external environment and lead the needs of the consumer market, the company has adjusted channel strategies in a timely manner to “2B2C, two -wheel drive development.”On the one hand, with the company’s long -term channel resources and advantages on the B -end, gradually expand research and development according to market demand, and further enhance the “crystal flower” powder oil, coffee, “Jiazhi flavor” syrup, “Carima” coconut milk and thickInnovative foods such as alcoholic milk milk and other products are competitive to expand sales channels and customer resources; on the other hand, thanks to consumers’ pursuit of taste, enhancement of health and environmental awareness, more and more consumers pay attention to consumer individualsExperience and products that meet the trend of health and environmental protection.The company has a forward -looking layout of research and development, and has launched the “very wheat” oatmeal, “Golden Cat” coffee, “Su Xiao Wan” prefabricated dessert and other products sold for C -side channels to quickly expand channels and improve corporate profitability.

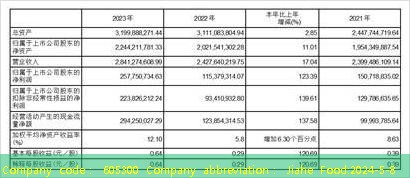

3 Company’s main accounting data and financial indicators

3.1 Main accounting data and financial indicators in the past 3 years

Unit: Currency: RMB

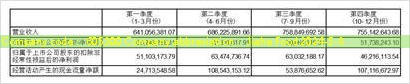

3.2 The main accounting data of the reporting period in the reporting period

Unit: Currency: RMB

Quarter

□ Applicable √ Not applicable

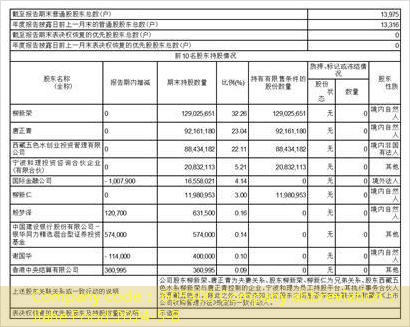

4 shareholders

4.1 Reporting period and annual report disclosure of the total shareholders of ordinary shareholders at the end of the first month, the total number of shareholders and the total number of shareholders of the preferred shareholders and the total number of shareholders and the top 10 shareholders who hold special voting rights

Unit: stock

4.2 Fragments of the property rights and control relationship between the company and the controlling shareholder

√ Applicable □ Not applicable

4.3 Fragments of the property rights and control relationship between the company and the actual controller

√ Applicable □ Not applicable

4.4 The total number of shareholders of the company’s preferred shareholders and the top 10 shareholders at the end of the report period

□ Applicable √ Not applicable

5 company bond status

□ Applicable √ Not applicable

Section 3 important matters

1 The company shall disclose major changes in the company’s operation during the reporting period according to the principle of importance, as well as matters that have significant impacts on the company’s operating conditions and expected in the future during the reporting period.

During the reporting period, the company’s operating income was 2.841 billion yuan, an increase of 17.04%year -on -year; net profit attributable to shareholders of listed companies was 258 million yuan, an increase of 123.39%year -on -year; net assets belonging to shareholders of listed companies were 2.244 billion yuan, an increase of 11.01%year -on -year;The overall net interest rate was 9.03%, a year -on -year increase of 4.28 percentage points.

If there is a warning of delisting risk or termination of listing after disclosure of the annual report of the company, it shall disclose the reasons that cause the delisting risk warning or terminate the listing situation.

□ Applicable √ Not applicable

The board of directors of the company and all directors guarantee that there are no false records, misleading statements or major omissions in this announcement, and assume legal responsibility for the authenticity, accuracy and integrity of its content.

Jiahe Food Industry Co., Ltd. (hereinafter referred to as “Company”) The fifteenth meeting of the second board of directors was held on the spot on April 17, 2024 at No. 70 Yanyan East Road, Wujiang District, Suzhou City.Directors were delivered through emails on April 7, 2024.The meeting should participate in 7 directors who voted, and 7 directors who actually participated in the voting (of which: the communication method attended 0 directors).

The meeting was chaired by Liu Xinrong, chairman, and supervisors and executives.The meeting was held in accordance with relevant laws, regulations, regulations, and “Articles of Association”.After careful review by the directors, the meeting formed the following resolutions:

1. Review and pass the “Proposal on the Work Report of the General Manager of 2023”

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

2. Review and pass the “Proposal on the Work Report of the Board of Directors 2023”

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

This proposal needs to be submitted to the shareholders’ meeting for consideration.

3. Review and pass the “Proposal on the Report on the 2023 Performance of the Board of Directors”

For details, please refer to the “Report on the 2023 Performance of the Board of Directors 2023” disclosed by the company disclosed on the Shanghai Stock Exchange website (www.sse.com.cn).

This proposal has been reviewed and approved by the company’s audit committee.

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

4. Review and pass the “Proposal on the Evaluation Report of the Performance of the Accounting Firm in 2023 and the Report on the Report of the Supervision Responsibilities” of the Audit Committee

For details, please refer to the “Evaluation Report on the Performance of the 2023 Accounting Firm” and “2023” and “Audit Commission’s 2023 report of the accounting firm’s performance report on the implementation of the supervision duties in the 2023 Accounting Firm’s Performance Report of the 2023 Accounting Firm.”.

This proposal has been reviewed and approved by the company’s audit committee.

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

5. Review and pass the “Proposal on Independent Directors 2023 Annual Report”

For details, please refer to the company disclosed in the “2023 Independent Directors Report (Wei Anning) 2023),” 2023 Independent Directors Report (Bei Zhengxin) “,” 2023 Independent Directors Report (Wei Anning) “,” 2023 “,” 2023, “2023 Independent Directors Report (Wang Derui).

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

This proposal needs to be submitted to the shareholders’ meeting for consideration.

6. Review and pass the “Proposal on Independent Self -Inspection of Independent Directors”

For details, please refer to the “Special Opinions on the Independent Directors’ Independence of Directors” on the website of the Shanghai Stock Exchange (www.sse.com.cn).

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

7. Review and pass the “Proposal on the Financial Consumption Report of 2023”

This proposal has been reviewed and approved by the company’s audit committee.

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

This proposal needs to be submitted to the shareholders’ meeting for consideration.

8. Review and pass the “Proposal on the 2024 Financial Budget Report”

This proposal has been reviewed and approved by the company’s audit committee.

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

This proposal needs to be submitted to the shareholders’ meeting for consideration.

9. Review and pass the “Proposal on the 2023 Annual Report and its abstract”

For details, please refer to the “Annual Report 2023” and “2023 Annual Report Abstract” of the company disclosed in the Shanghai Stock Exchange website (www.sse.com.cn).

This proposal has been reviewed and approved by the company’s audit committee.

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

This proposal needs to be submitted to the shareholders’ meeting for consideration.

10. Review and pass the “Proposal on the 2023 Morality Distribution Plan”

For details, please refer to the company disclosed on the “Announcement on the 2023 Interest Distribution Plan” on the Shanghai Stock Exchange website (www.sse.com.cn).

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

This proposal needs to be submitted to the shareholders’ meeting for consideration.

11. Review and pass the “Proposal on Renewal Accounting Firm”

For details, please refer to the “Announcement on Renewal Accounting Firm” by the company’s disclosure on the website of the Shanghai Stock Exchange (www.sse.com.cn).

This proposal has been reviewed and approved by the company’s audit committee.

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

This proposal needs to be submitted to the shareholders’ meeting for consideration.

12. Review and pass the “Proposal on the Internal Control Evaluation Report 2023”

For details, please refer to the “Internal Control Evaluation Report 2023” by the company disclosed on the Shanghai Stock Exchange website (www.sse.com.cn).

This proposal has been reviewed and approved by the company’s audit committee.

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

13. Review and pass the “Special Report on Special Reports on the Storage and Actual Usage of Moistowing funds in 2023”

For details, please refer to the “Special Report on the Storage and Actual usage of funds raised and actual usage” by the company disclosed on the website of the Shanghai Stock Exchange (www.sse.com.cn).

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

14. Review and pass the “Proposal on the Estimation of the Inspection of the Annual Guarantee in 2024”

The board of directors believes that this guarantee is made by comprehensively considering the needs of the business development of the guarantor, which is conducive to the company’s stable and sustainable development, which is in line with the company’s actual business situation and overall development strategy.Effective control, the guarantee risk is generally controllable.

For details, please refer to the “Announcement on Estimated to the Sales Quota of 2024” by the company’s disclosure on the website of the Shanghai Stock Exchange (www.sse.com.cn).

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

This proposal needs to be submitted to the shareholders’ meeting for consideration.

15. Review and pass the “Proposal on Application of Financing Credit Credit in 2024”

For details, please refer to the “Announcement on Application Financial Credit Tendor Elimination in 2024” by the company’s disclosure on the website of the Shanghai Stock Exchange (www.sse.com.cn).

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

This proposal needs to be submitted to the shareholders’ meeting for consideration.

16. Review and pass the “Proposal on the use of its own funds for cash management”

For details, please refer to the “Announcement on the use of its own funds for cash management” by the company’s disclosure on the website of the Shanghai Stock Exchange (www.sse.com.cn).

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

17. Review and pass the “Proposal on the use of raised funds for cash management”

For details, please refer to the “Announcement on the use of raised funds for cash management” by the company’s disclosure on the website of the Shanghai Stock Exchange (www.sse.com.cn).

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

18. Review and pass the “Proposal on Daily Correlation Transactions in 2024”

This proposal has been reviewed and approved by the company’s independent directors.

For details, please refer to the “Announcement on Estimated Daily Related Transactions in 2024” by the company’s disclosure on the website of the Shanghai Stock Exchange (www.sse.com.cn).

Voting: Agree with 5 votes, 0 votes against 0 votes, 0 votes, and related directors Liu Xinren and Liu Xinrong to avoid voting.

19. Review the “Proposal on Confirmation of Directors’ 2023 Salary and 2024 Annual Compensation Plan”

This proposal has been reviewed by the company’s salary and assessment committee, and unanimously agreed to submit to the board of directors for consideration.

All directors avoided voting for this proposal, and this proposal was directly submitted to the shareholders’ meeting for consideration.

20. Review and approve the “Proposal on Confirming Senior Management Personalized Annual Salary and 2024 Annual Removation Plan”

This proposal has been reviewed and approved by the company’s salary and assessment committee.

Voting: Agree with 4 votes, 0 votes against 0 votes, 0 votes, and related directors Liu Xinrong, Liu Xinren, and Zhang Jianwen avoided voting.

21. Review and pass the “Proposal on the 2023 Social Responsibility Report”

For details, please refer to the “Social Responsibility Report 2023” on the Shanghai Stock Exchange website (www.sse.com.cn).

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

Twenty -two, review and pass the “Proposal on Carrying out Futures Setting During the Preservation Business”

For details, please refer to the “Announcement on Carrying out the Futures Setting Dialogue Valuation Business” by the company disclosed in the Shanghai Stock Exchange website (www.sse.com.cn).

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

23. Review and approve the “Feasibility Analysis Report on Carrying out Futures Setting During Dating Business”

For details, please refer to the company disclosed on the feasibility analysis report on the feasibility preservation business of futures setting period “on the website of Shanghai Stock Exchange (www.sse.com.cn).

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

Twenty -four, review and pass the “Proposal on the first quarter of 2024”

For details, please refer to the “Report of the First quarter of 2024” that the company disclosed on the website of the Shanghai Stock Exchange (www.sse.com.cn).

This proposal has been reviewed and approved by the company’s audit committee.

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

25. Review and pass the “Proposal on Adjusting the Audit Committee Member”

For details, please refer to the “Announcement on Adjusting the Audit Committee Member” by the company’s disclosure on the website of the Shanghai Stock Exchange (www.sse.com.cn).

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

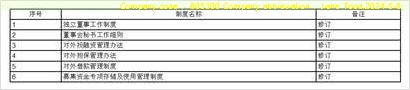

26. Review and pass the “Proposal on Amending the Company’s System”

In order to further improve the corporate governance structure and better promote the company’s standardized operation, in accordance with the “People’s Republic of China Company Law”, “The Securities Law of the People’s Republic of China”, “Management Measures for the Disclosure of Listed Companies”, “Administrative Measures for the Independent Directors of Listed Companies”The provisions of regulations and standardized documents, combined with the actual situation of the company, are planned to revise some of the company’s system, and the amendment of the specific system is as follows:

For details, please refer to the relevant system of the company disclosed on the website of the Shanghai Stock Exchange (www.sse.com.cn).

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

27. Review and pass the “Proposal on Holding the 2023 Annual General Meeting”

For details, please refer to the “Notice on Holding the 2023 Annual shareholders’ meeting” by the company’s disclosure on the website of the Shanghai Stock Exchange (www.sse.com.cn).

Voting: Agree with 7 votes, 0 votes against 0 votes, and 0 votes.

Special announcement.

Jiahe Food Industry Co., Ltd.

Board of Directors

April 19, 2024